Scientific Skincare Concepts Expand into Baby Care

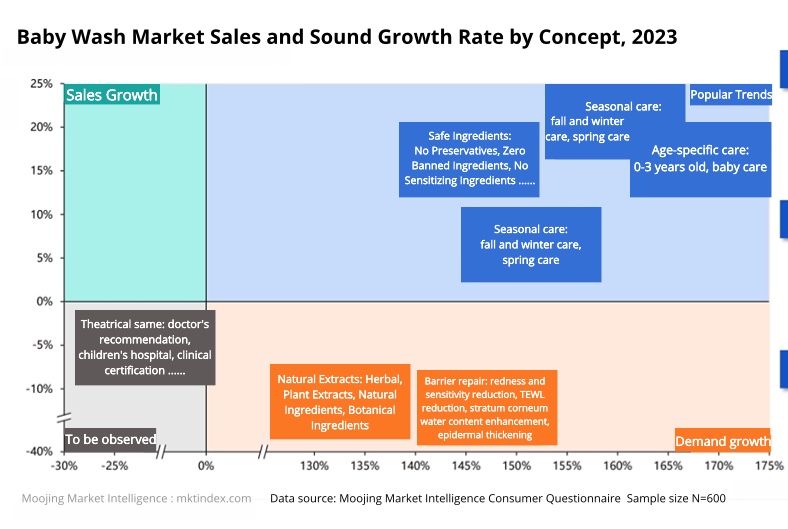

The concept of scientific skincare is now reshaping the baby skincare market. “Barrier repair” for babies has become a trending topic on social media, with a 142% year-on-year increase in discussions. This highlights a growing awareness of skincare for babies, especially among parents of children aged 0–3.

Despite the growing buzz, this need remains underserved. In 2023, online sales of baby barrier repair products totaled just 0.2 billion yuan, with 101,000 units sold. These products accounted for only 0.16% of the baby care market. This reveals an underdeveloped, low-competition segment filled with growth and innovation opportunities.

Related Article: Functional Skincare Drives China’s Baby Care Trends

Market Potential and Innovation Direction

It is a blue ocean market ripe with opportunities. The question arises: where can baby skincare brands find innovation and gain growth? Magic Mirror’s report offers a detailed analysis to guide these brands in capitalizing on these opportunities. The insights presented are drawn from Magic Mirror Insight’s “Baby and Child Skin Barrier Repair White Paper.”

– Consumer survey: consumer questionnaire with a sample size of 600

Related Article: Functional Skincare Drives China’s Baby Care Trends

01) Baby Skin Care Market Consumer Research

Target Consumer Profile

The main caregivers of babies aged 0–3 are educated, high-income women aged 25–35. Their education leads to a rational, scientific view of parenting, while their income allows greater flexibility.

Skin issues in babies vary by age and location. In second-tier cities, 61.1% of babies experience skin issues, a higher rate than in smaller markets.

Core Consumer Needs

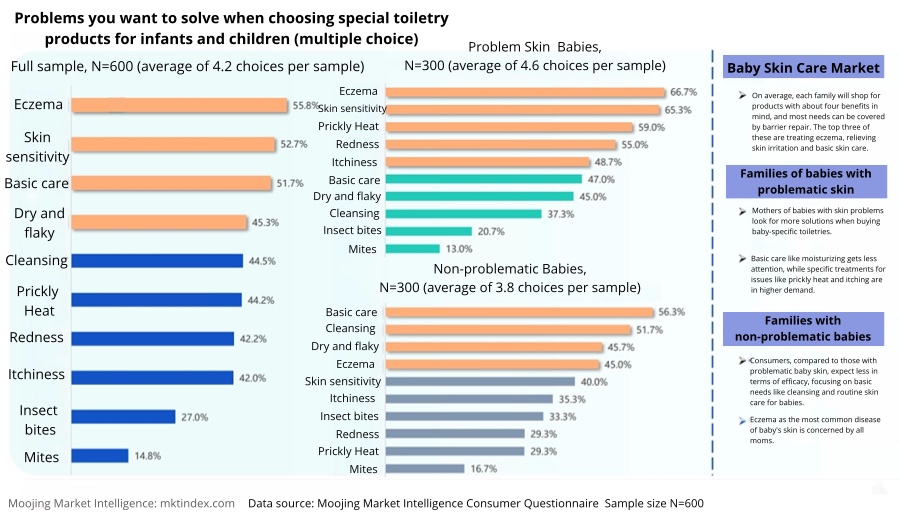

Among the baby skin issues that concern mothers, prickly heat, allergies, and eczema (like milk and drooling rashes) are the top three, causing babies to scratch and cry.

Age-specific problems vary:

- Skin problems occur across all age groups

- 0–1 years: diaper rash is most common

- 1–3 years: prickly heat and allergies increase

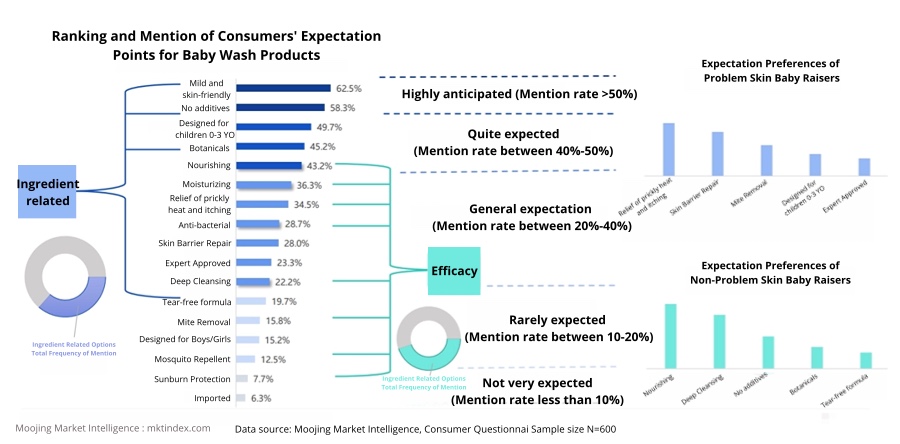

Therefore, parents prioritize the efficacy of products when making purchases, with ‘moisturizing’ and ‘hydrating’ effects being the top concerns. Both of these belong to the basic skincare needs. The expectation for ‘sun protection’ is relatively low. However, when looking more closely, the highest consumer expectations are for ‘gentle on the skin’ and ‘additive-free,’ both of which are closely related to product safety.

Related Article: Booming Youth and Child Skincare Market in China

Additionally, on average, each family considers about four types of effects when selecting products, most of which can be covered by barrier repair. The top three priorities are treating eczema, relieving skin irritation, and providing basic skin care.

In contrast, parents of babies with sensitive skin have higher expectations for product efficacy. Beyond relief from prickly heat and itching, they highly value skin barrier repair. They also place more importance on age-appropriate care and expert certification.

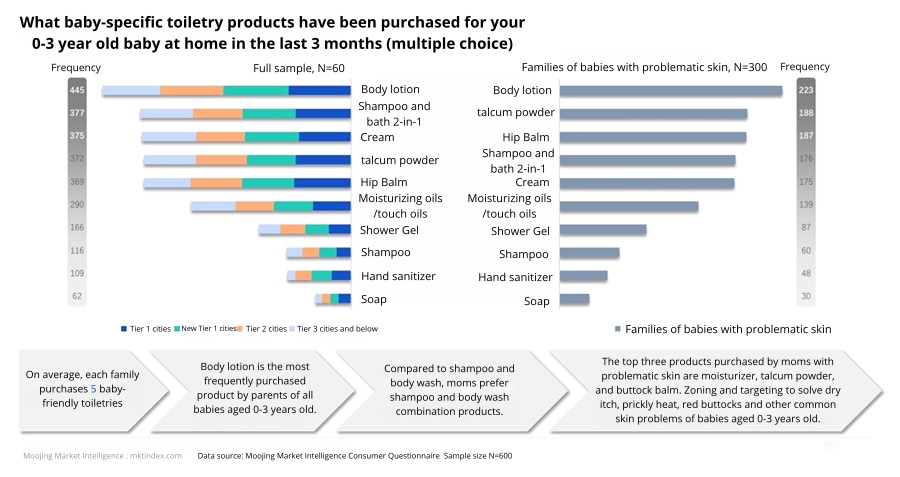

Babies under 1 year old, their skin are too delicate and relatively simple to clean and care for. Thus, mothers prefer to purchase ‘combination’ products (for example, those that serve both as shampoo and body wash). Families with babies aged 1-3 years, as well as those with babies having problematic skin, place a higher emphasis on the refinement of skincare and prefer products designed for zoned care.

The top three products for babies with problematic skin purchased by mothers are moisturizer, talcum powder, and buttock balm. Zoning targeted to solve dry itching, prickly heat, red buttocks and other common skin problems of babies 0-3 years old.

Data indicates that the concepts of seasonal, age-specific, and zonal care are popular on social media and with consumers, with sales up by 18.2%, 18.3%, and 8.9% respectively.

Purchase Channel

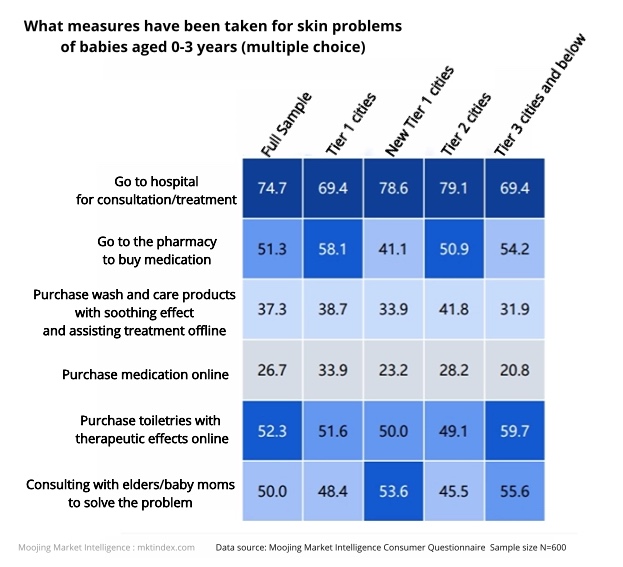

When babies aged 0-3 face skin issues, parents first turn to the hospital. Beyond medication, they also prefer buying scrubs online that soothe and aid in treatment to address the problem.

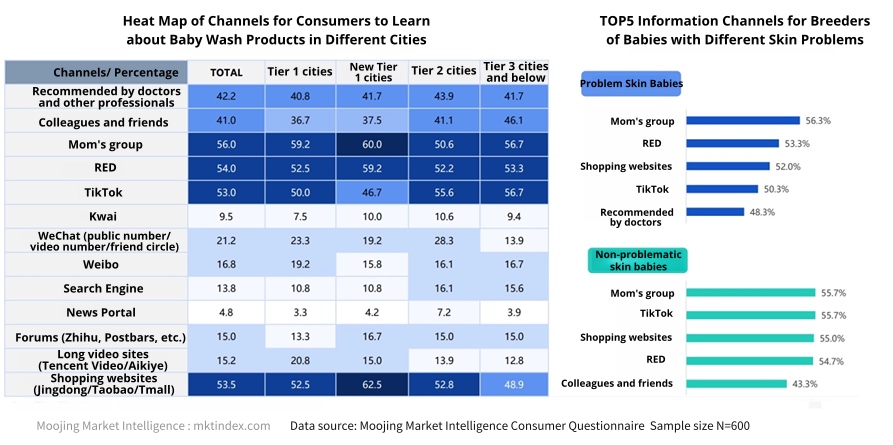

“Mom’s groups” are key info sources for new parents, acting as private hubs for traffic. Discussions often cover baby skincare issues and product recommendations.

As a popular social media software, Xiaohongshu and TikTok are even more important than professional traditional e-commerce platforms among mothers. Mothers will take the initiative to do their homework on product information before purchasing after being recommended. At the same time, contemporary mothers approach parenting with a more scientific mindset. Particularly, mothers of babies with problematic skin are more inclined to heed the recommendations of professionals such as doctors.

Related Article: Understanding and Solving Chinese New Moms’ Dilemma: 3 Insights from Medela

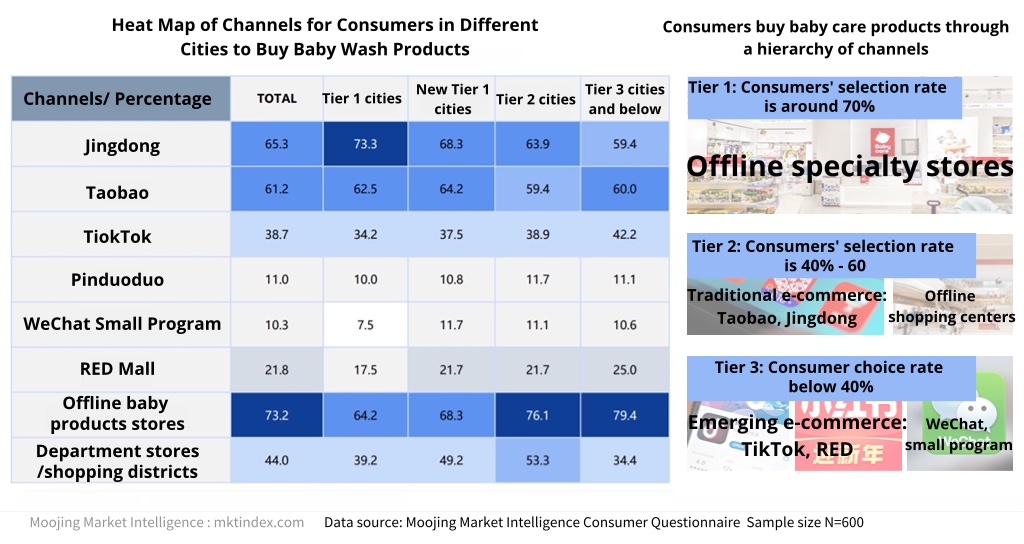

Overall, offline baby stores are the preferred channel for consumers to buy baby care products, followed by Jingdong and Taobao. However, consumers in different levels of cities have different channel preferences, with Jingdong preferred in first-tier cities and offline purchases preferred in sinking cities.

Comparing the information acquisition channels, the mom’s group on WeChat has the highest usage rate, but very few go through the WeChat channel when purchasing. TikTok and Xiaohongshu are more of a source of information for consumers.

02) Baby Barrier Repair Track Insights

In the face of widespread consumer demand, how is the baby barrier repair market performing?

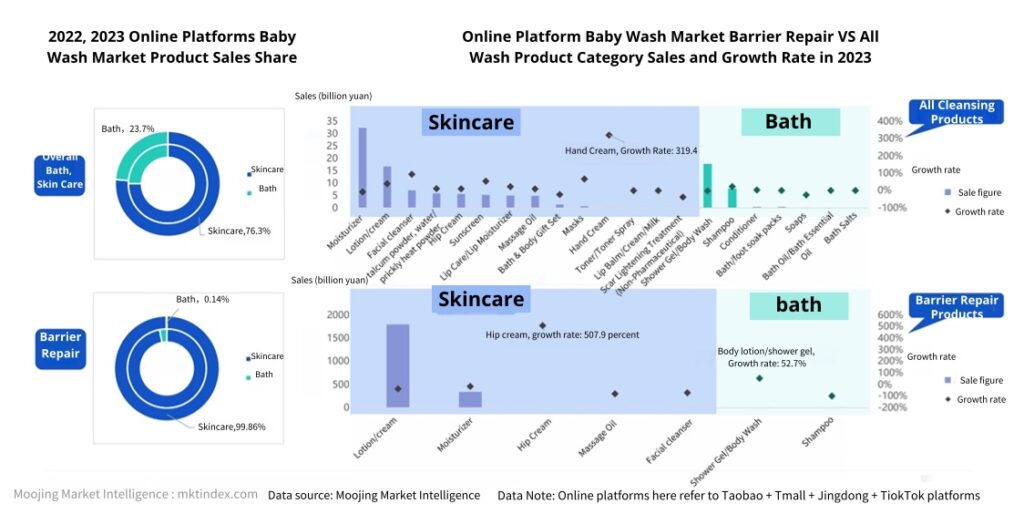

According to Magic Mirror Analytics+ data, the concept of “barrier repair” is mainly found in the skin care category, which accounted for 76.3% of sales in 2023, a slight increase from 2022.

Among them, lotions, creams and moisturizers are the main categories with high frequency of daily use, occupying more than 99% of the online market share.

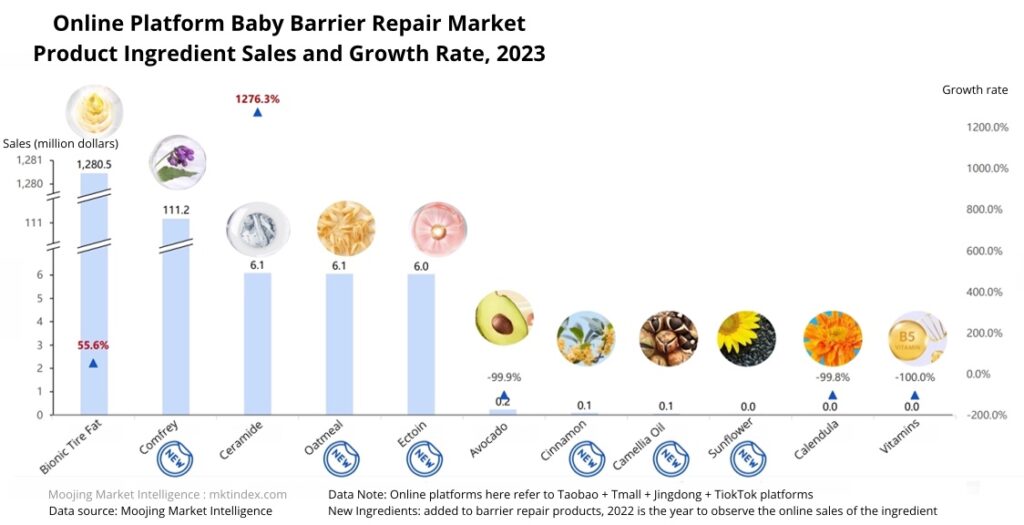

In the main barrier care baby care products, “bionic lanolin” is the top ingredient by market volume, with 2023 sales over ten million yuan and a 55.6% growth rate. While “ceramide” has the highest growth rate, its market volume is much smaller, at the ten thousand yuan level, and other non-new ingredients are seeing negative growth.

Among new ingredients, “comfrey” has the largest market volume. Known for its anti-irritant and anti-allergic properties, comfrey’s soothing effects make it a favored ingredient in many barrier care products.

On the brand side, consumers prefer to buy the same brand of toiletry matrix products, especially for babies with problematic skin.

Nearly 60% of consumers prefer to purchase baby care products from the same brand. First-tier city consumers favor a single brand’s product range, whereas those in third-tier and lower cities tend to mix and match products from different brands.

Looking at the age distribution of babies, those aged 0-2 years, due to their delicate skin, have a higher cost associated with trying and potentially making mistakes with cleansing and care products. As a result, they parents tend to prefer buying products from the same brand. In contrast, babies aged 2-3 years, whose skin is maturing, allow caregivers to start experimenting with products from a variety of brands.

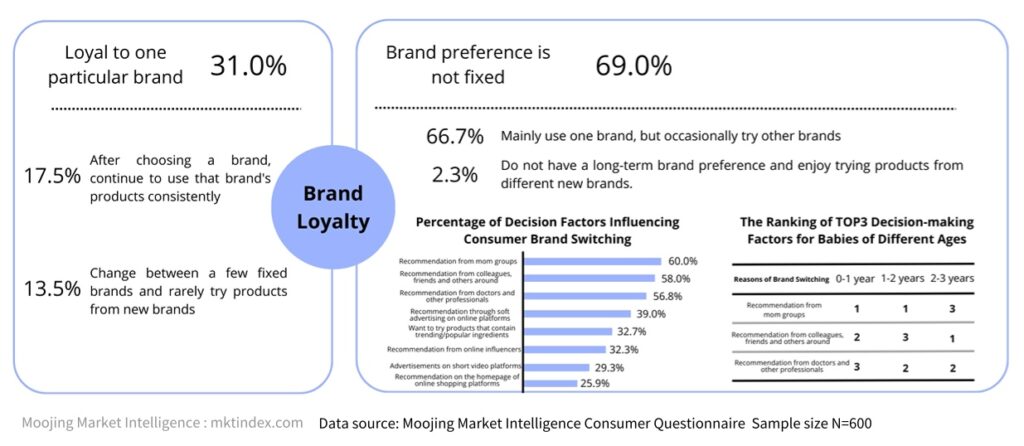

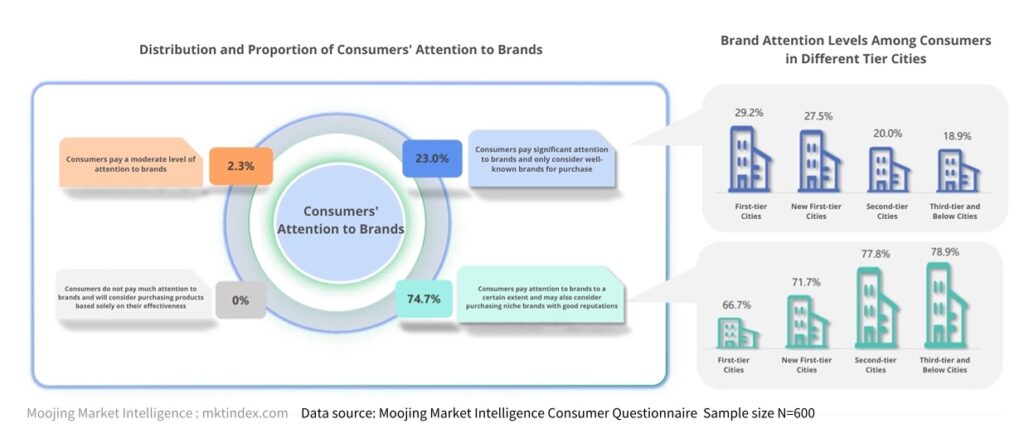

Consumers care significantly about the brand of baby care products, with only 2.3% not concerned about it. Over 90% are concerned with the brand, and 74.7% value the brand while also considering its reputation and strength, not just brand awareness.

Consumers in first-tier cities focus more on brand awareness, while those in sinking cities prioritize a brand’s reputation and strength.

Related Article: Booming Youth and Child Skincare Market in China

Key Drivers of Brand Switching

69.0% of consumers have switched baby skincare brands due to multiple factors.

The top three influencers are:

- Mom groups

- Friends or colleagues

- Doctors and professionals

The first two reflect private traffic, while the third reflects professional authority in the baby skincare market.

Different baby age groups show varied preferences: Parents of 0–2 year olds rely heavily on mom group recommendations when choosing wash and care products.