CBME China 2025 Food Pavilion Highlights Unveiled

CBME China 2025 Food Pavilion: Explore the latest food trends and innovations for children and babies, featuring top brands and new products.

Cool Kids Fashion Highlights

Discover Cool Kids Fashion 2025 in Shanghai — a leading event for global children’s wear brands, fashion trends, and sustainable design.

Discover German Maternity & Baby Products

Explore premium German baby care and maternity brands at CBME 2025 — where quality, safety, and innovation meet.

Discover Hong Kong Maternity & Baby Products

Meet Hong Kong’s top baby and maternity brands at CBME 2025 — discover trusted, export-ready products in one place.

Unlocking Southeast Asia’s Growth in the Mother and Baby Product Market: Key Trends and Go-to-Market Strategies in Vietnam

Vietnam’s baby & kids market is booming with 1M newborns yearly. Learn key trends in infant nutrition, kidswear, toys, and e-commerce strategies for 2024.

Discover Premium Korean Maternity & Baby Products

Meet 20+ Korean baby brands at CBME 2025. Discover trusted suppliers for skincare, feeding, and kids’ essentials — all in one place.

Discover Premium Japanese Maternity & Baby Products

Discover 25+ Japanese baby care brands at CBME 2025. From skincare to fashion, meet trusted suppliers and explore new business opportunities.

Discover CBME China 2025 Category Markets & Special Sourcing Zones

Explore curated product markets and sourcing zones at CBME 2025, covering baby fashion, toys, formula, and essentials.

Discover CBME China 2025 New Products Pavilion

New Products Pavilion highlights over 100 innovative brands and new launches in the children, baby, and maternity industry.

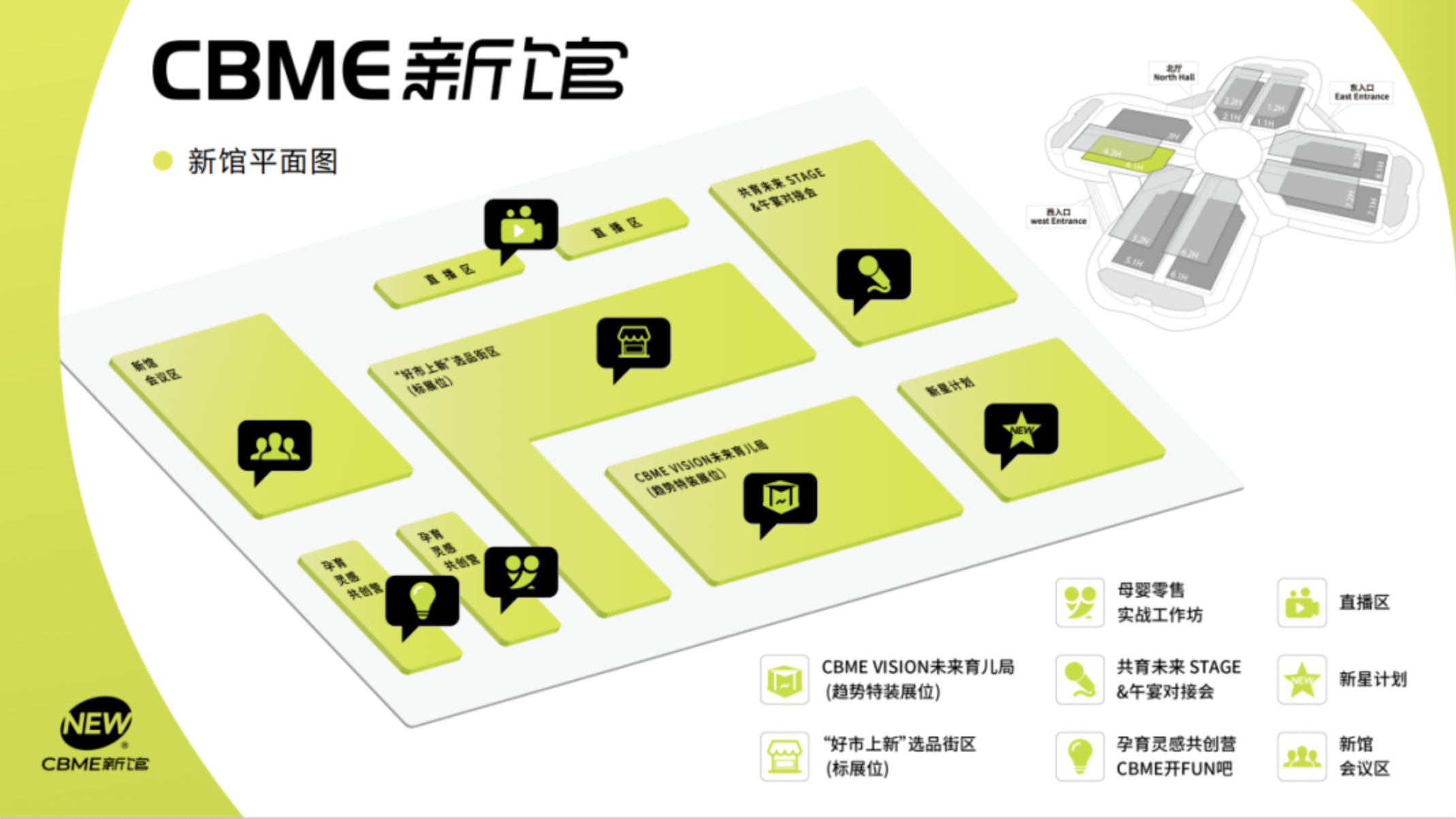

Discover CBME Diverse Zones: Your Key to More Productive Visit

Explore CBME China 2025 Show Guide to plan your visit efficiently. Discover essential information on dates, venue, exhibitor lists, and onsite activities.